Marketplace management

The trip economy is a set of marketplaces for mobility. Each operator has a range of levers it can adjust to more effectively meet demand, and in particular manage demand peaks when supply is stretched. There are three strategies for doing this.

Smoothing and flattening demand

The first option is to change the structure of the demand curve. When more demand can be served with the same fleet of vehicles and pool of labor, the cost of each trip is lower.

This can be done by pooling different types of demand, using the same fleet to serve it. For instance, Uber drivers can choose to do UberX and Uber Eats rides at the same time. This means that each trip - a ride or a food delivery - can be assigned to the closest driver from a larger pool of drivers, improving the efficiency of the trip. Since the demand peaks for UberX and Uber Eats are different, the overall demand curve is smoother, while the supply pool serving these trips is larger overall, making it less expensive to serve the peaks.

Expansions into adjacent services - such as DoorDash's DashMart and DoorDash Drive offerings or Amazon's grocery delivery service - are driven by this logic. So too are mergers of fleets serving overlapping demand pools such as Uber's acquisition of Careem or DoorDash's purchase of Caviar.

Beyond just smoothing the demand curve, it is also possible to flatten the curve by combining different trips into the same ride. The clearest example of this is UberPool, in which two or more people heading in a similar direction travel together for a portion of the ride. Transit works according to the same principle: people need to reach a transit line, but along these routes trip costs are lower because many trips can be combined into one. Batching similarly frees up supply for delivery and it is even possible to combine outbound trips moving people with inbound trips carrying cargo. However, high trip density is required for all these services to maintain short wait times and a good customer experience.

This kind of bundling rewards a diversified set of trip offerings so long as the marketplace has sufficient scale and technology to support the increased complexity to allow effective matching and routing. Overall, as markets consolidate, demand and supply can more efficiently be matched, but competition is required to make sure that consumers rather than businesses capture the benefits of this increased efficiency.

Dynamic pricing

Suddenly it starts to rain and everyone wants a cab or to order in food. These kinds of demand spikes happen periodically in trip marketplaces and some of them can't be predicted or controlled. When demand exceeds supply, supply needs to be rationed in some way to cover the shortfall. Ridehailing companies have done this by increasing price. This so-called "surge pricing" primarily reduces demand, ensuring that those most willing to pay for an immediate ride can get one. It also induces more supply, and to the extent that it does this, it significantly improves service quality in comparison to fixed-price taxis.

The idea for Uber was born when a Parisian snowstorm made it impossible for the founders to hail a cab. Consequently, the company was built on a philosophy of zealously addressing such market inefficiencies through price signals and it embraced confrontation in achieving this mission. But surge pricing is very unpopular and the optics have been particularly damaging to the company. Having prices spike during a hurricane or a terrorist attack is not a good look; there are ways to restrict demand without evoking accusations of price gouging. And a breakdown of trust can add up.

Over time, mobility services have become better at framing surge policies, for instance by giving customers an alternate option to book a cheaper ride within a longer time window or reducing the service area for food deliveries during bad weather. Ridehailing pricing has increasingly been tailored to each trip using algorithmic pricing which also helps to smooth demand. But it is better for both customers and trip marketplaces when things are predictable.

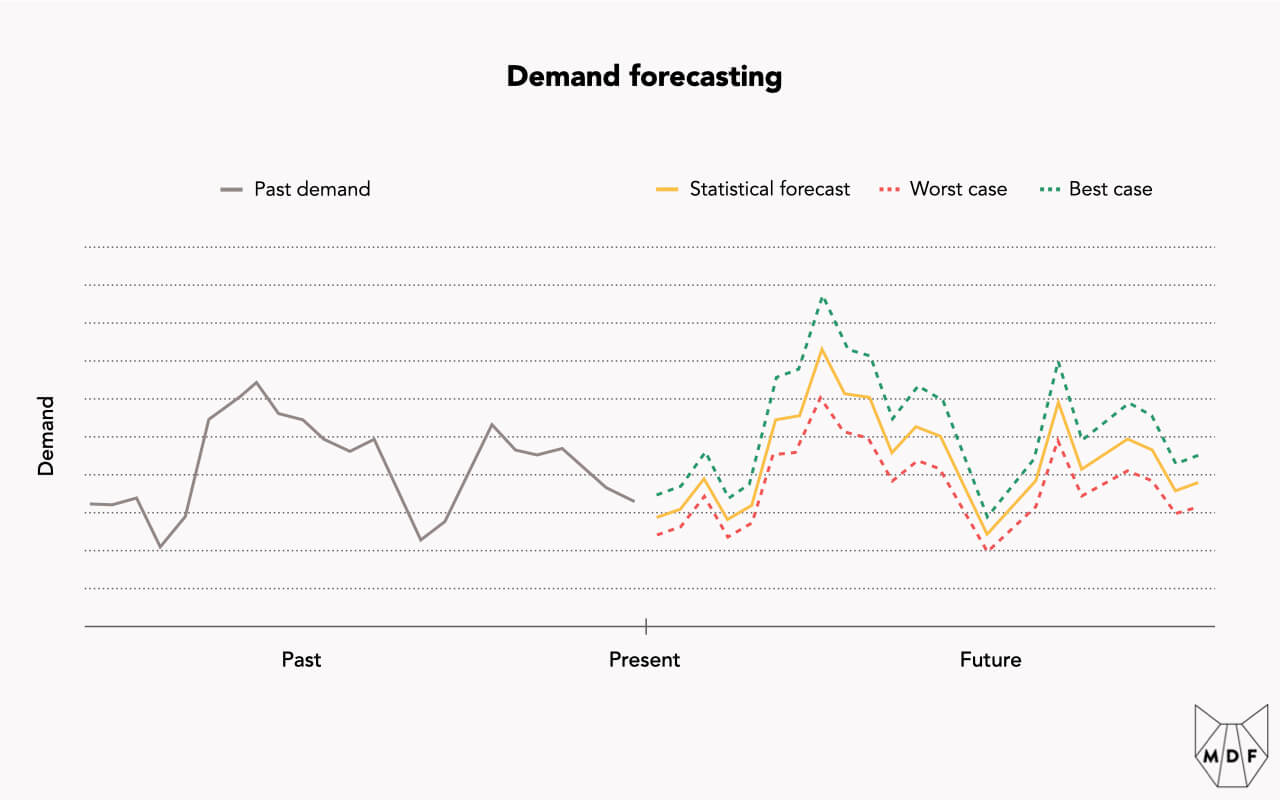

Forecasting

Trip economies tend to be seasonal in nature, with repeating patterns based on weather, holidays and a range of other factors. Over the long term, it is possible to build increasingly accurate models to predict future demand and adjust the supply and demand side of the marketplace accordingly. Ridehailing companies have analytics teams that model market dynamics across cities for various days of the year (e.g. New Year's Eve) that marketing and operations teams use to create targeted incentives to align supply and demand. Meanwhile scooter sharing companies are doing similar forecasting to determine promotions (e.g. free unlocks during winter) and to plan when to move scooters off the streets or between cities as seasons change.

Visibility into the future matters even on shorter time horizons: pooling rides is much easier to do when demand is scheduled in advance or repeats regularly. This matters for shuttle bus services and carpooling, but is also baked into incentives such or Uber's "favorite route boost" which gives bonus loyalty points for trips between favorite locations.

Social